One of the other things that gets me about the debate on the costs of climate change legislation is that it usually doesn't include the potential costs of inaction. Modeling the costs of inaction is even more difficult, since you have to make assumptions not only about the future of the economy, but also about the future of the weather.

The World Bank just released a new study using this type of guesswork to estimate that the costs of climate change could total as much as $100 billion every year for the developing world alone.

While I put even less faith in this study than I do in most cap and trade studies, it's worth noting a couple of things. First, this is only the cost to poor countries -- the cost to rich countries could be much higher. We have more roads, bridges, houses, etc, so we will have more to rebuild after a disaster (it could also be lower if poor countries get all the bad weather).

Second, $100 billion is a lot, but it's even more when you think about it in relation to the income of developing countries. The GDP of Sub-Saharan Africa (an area larger than the US and China combined) was $1.5 trillion in 2008, so climate change could cost Africa almost 7% of its GDP every year. This can't be good for business.

Wednesday, September 30, 2009

Tuesday, September 29, 2009

Once Upon a Time...

Long ago in a distance land, I, Ryan, was an Analyst in the energy sector. I've been busy with mundane work in my new life (you know, simple things like printing) so there hasn't been much to report recently on project "Saving the World, One Seamstress At A Time" (I wonder if IPA would let me make that the official name?). On the other hand, there's been a lot of action in the energy sector of the US, so I thought I'd reminisce.

Exelon, PNM, and PG&E all quit the US Chamber of Commerce over its "obstructionist tactics" in opposing cap and trade legislation. Both Krugman and Freedman respond.

I know nothing at all about the Chamber of Commerce, but I did sit next to people who model the costs of cap and trade legislation for 2 years (and that makes me an expert, right?). The bottom line: the entire debate over the cost of climate change legislation boils down to what "societal discount rate" and technological growth rate you use. Simple, right?

In non-economist-speak, this translates to how much you care whether the price of electricity increases in the future and whether you think new technology will be able to keep prices low. Even simpler: It's all a bunch of "best-guess" rubbish that hinges on things we really have no idea about.

So if the cap and trade models are uninformative, does the fact that major energy utilities are on board with cap and trade mean that the price of energy won't rise? Probably not. Many utilities are on board, but many utilities also stand to benefit from higher prices. Exelon has ton of clean nuclear that it will be able to sell to people in Pittsburgh relying on coal. PG&E is Californian, so they're just odd (and also big on energy efficiency and renewables). PNM I know little about, except that they were stung by the high oil/gas prices in 2007-20008. Perhaps cap and trade would help them diversify away from commodity-driven generation (or maybe they're just odd as well?).

Who's a public politician to trust if you can't rely on the models and utilities are all playing their own games? Well... that's part of why I left the industry. It can be hard to find reliable data on energy policy issues. (I was very lucky to be working with a group with a strong belief in sticking to the facts as we saw them).

The truth is often somewhere in the middle. Cap and trade (if effective) will result in people losing their jobs, and it will suck for a lot of families to pay higher electricity prices. This much is certain. But I still think higher energy prices are desperately needed; climate change could result in many people losing their lives and many others struggling through persistent drought, displacement from natural disasters, etc, and I care about that a lot more.

Exelon, PNM, and PG&E all quit the US Chamber of Commerce over its "obstructionist tactics" in opposing cap and trade legislation. Both Krugman and Freedman respond.

I know nothing at all about the Chamber of Commerce, but I did sit next to people who model the costs of cap and trade legislation for 2 years (and that makes me an expert, right?). The bottom line: the entire debate over the cost of climate change legislation boils down to what "societal discount rate" and technological growth rate you use. Simple, right?

In non-economist-speak, this translates to how much you care whether the price of electricity increases in the future and whether you think new technology will be able to keep prices low. Even simpler: It's all a bunch of "best-guess" rubbish that hinges on things we really have no idea about.

So if the cap and trade models are uninformative, does the fact that major energy utilities are on board with cap and trade mean that the price of energy won't rise? Probably not. Many utilities are on board, but many utilities also stand to benefit from higher prices. Exelon has ton of clean nuclear that it will be able to sell to people in Pittsburgh relying on coal. PG&E is Californian, so they're just odd (and also big on energy efficiency and renewables). PNM I know little about, except that they were stung by the high oil/gas prices in 2007-20008. Perhaps cap and trade would help them diversify away from commodity-driven generation (or maybe they're just odd as well?).

Who's a public politician to trust if you can't rely on the models and utilities are all playing their own games? Well... that's part of why I left the industry. It can be hard to find reliable data on energy policy issues. (I was very lucky to be working with a group with a strong belief in sticking to the facts as we saw them).

The truth is often somewhere in the middle. Cap and trade (if effective) will result in people losing their jobs, and it will suck for a lot of families to pay higher electricity prices. This much is certain. But I still think higher energy prices are desperately needed; climate change could result in many people losing their lives and many others struggling through persistent drought, displacement from natural disasters, etc, and I care about that a lot more.

Wednesday, September 23, 2009

Are you a Kwesi or a Kofi?

One of the many things I have shouted at me as I walk down the street here is “Kwesi!” or “Obruni Kwesi!” As with most things, I ignored it at first. At the same time, when I was meeting respondents or other random people and practicing my Twi, one of the first things that they would ask is “Are you a Kwesi?” I always respond, “No, I am a Kofi” and they crack up hysterically. I always thought they were laughing at my Twi…

A little background: A common tradition in southern Ghana is to name your children after the day of the week they were born on. As best I recall, I was born on a Friday, so my Ghanaian name is Kofi. Kwesi is the name for a male born on Sunday.

So why did they assume I was a Kwesi? Well, it turns out – and this is something I am not at all comfortable with, but was explained to me by several people independently – it turns out that a common belief in some of the communities I work in is that more white people are born on Sunday. Sunday is a day of worship. It is God’s day; Sunday is closer to God. White people are very lucky to have been born white. It is a reward from God to be born white; white people stand closer to God. White people are therefore more likely to have been born on a Sunday.

Why is it hysterical that I insisted I was not a Kwesi, but a Kofi? You get paid on Fridays. It’s the end of the week. It’s a day to kick back. Friday is a day of sin. Kofis are partiers, chronic misbehavers, naughty. By saying that I was a Kofi, I was saying that I was down for a good time, which, apparently everyone else was too.

A little background: A common tradition in southern Ghana is to name your children after the day of the week they were born on. As best I recall, I was born on a Friday, so my Ghanaian name is Kofi. Kwesi is the name for a male born on Sunday.

So why did they assume I was a Kwesi? Well, it turns out – and this is something I am not at all comfortable with, but was explained to me by several people independently – it turns out that a common belief in some of the communities I work in is that more white people are born on Sunday. Sunday is a day of worship. It is God’s day; Sunday is closer to God. White people are very lucky to have been born white. It is a reward from God to be born white; white people stand closer to God. White people are therefore more likely to have been born on a Sunday.

Why is it hysterical that I insisted I was not a Kwesi, but a Kofi? You get paid on Fridays. It’s the end of the week. It’s a day to kick back. Friday is a day of sin. Kofis are partiers, chronic misbehavers, naughty. By saying that I was a Kofi, I was saying that I was down for a good time, which, apparently everyone else was too.

Thursday, September 17, 2009

Some Great Graphs...

I love graphs. Can't get enough of 'em. Good ones, at least. Like these:

The transition from an agrarian economy has never been shown clearer (ht Chris Blattman)

If only economists made graphs this clear...

The transition from an agrarian economy has never been shown clearer (ht Chris Blattman)

If only economists made graphs this clear...

Wednesday, September 16, 2009

My favorite charter school...

Has done it again!

Just look at the top of the English and Math lists, and see if you can guess which one I'm referring to...

Just look at the top of the English and Math lists, and see if you can guess which one I'm referring to...

Tuesday, September 15, 2009

How Do Economists Continue to Get it So Wrong?

I linked to Krugman's NYT article "How Did Economists Get it So Wrong?" with the comment, "Why I don't believe in Macro." The article has of course caused quite a stir, and I thought that I would clarify my position a bit: (macro)economists have always gotten it wrong, and continue to get it wrong.

Part of the reason I don't believe in macro is the way that many essentially valid (if limited) insights are put in a blender, mashed together and poured into the leaky economics 101-level understanding of the media. Nevertheless, I will now make some of the same types of baseless generalizations and ridiculous caricatures for your enjoyment (?).

Neither Keynesians nor Free Marketers have it right.

Free markers are right to attack as patently absurd the idea that government technocrats can set this ephemeral thing called "aggregate demand" to whatever level they please using fiscal stimulus. But you don't need to believe in the fiscal multiplier -- the amount of money $1 of government spending generates -- to think that the stimulus package was necessary to restore confidence in the economy. What we needed was a sign that Democrats and Republican (or at least Democrats) would be able to get their acts together and pass some aggressive legislation if they really needed to, which they did.

Keynesians are equally right to attack as patently absurd the idea that the efficient market hypothesis -- the idea that prices are always our best guess given the available information -- makes regulation unnecessary. In Chicago economist John Cochrane's response to Krugman, he writes, "But this argument takes us away from the main point. The case for free markets never was that markets are perfect. The case for free markets is that government control of markets, especially asset markets, has always been much worse." This argument takes us away from the main point: the government has always, and will always, set the rules of the game in markets. And right now, we need some better rules.

The financial crisis happened because everyone got it wrong. Bankers, regulators, mortgage brokers, home buyers, economists -- everyone. In response, everyone needs to look at what they did wrong and how they can do better, not start flame wars in the New York Times magazine pointing fingers. Economists can help make better rules and more effective government spending by focusing on the microeconomics of the institutional, collective action, and behavioral fields. At this point, economics is such a young and naive science that "general equilibrium" -- the attempt to model everything -- is a purely academic exercise with less practical relevancy than attempts to model the movements of ants in anthills. Let's take our best shot at figuring out what's wrong the with regulations we have, and see if we can't do a little better. Of course technocrats aren't any smarter than bankers and the new regulations might make things even worse; that's why we should test our theories using experiments. If things get screwed up anyway, we can always challenge the new rules under the "just and reasonable" standard of common law.

Maybe one day I'll believe in macro, but right now I say focus on the nerdy specifics of microeconomics and leave the macroeconomy to its "animal spirits."

Part of the reason I don't believe in macro is the way that many essentially valid (if limited) insights are put in a blender, mashed together and poured into the leaky economics 101-level understanding of the media. Nevertheless, I will now make some of the same types of baseless generalizations and ridiculous caricatures for your enjoyment (?).

Neither Keynesians nor Free Marketers have it right.

Free markers are right to attack as patently absurd the idea that government technocrats can set this ephemeral thing called "aggregate demand" to whatever level they please using fiscal stimulus. But you don't need to believe in the fiscal multiplier -- the amount of money $1 of government spending generates -- to think that the stimulus package was necessary to restore confidence in the economy. What we needed was a sign that Democrats and Republican (or at least Democrats) would be able to get their acts together and pass some aggressive legislation if they really needed to, which they did.

Keynesians are equally right to attack as patently absurd the idea that the efficient market hypothesis -- the idea that prices are always our best guess given the available information -- makes regulation unnecessary. In Chicago economist John Cochrane's response to Krugman, he writes, "But this argument takes us away from the main point. The case for free markets never was that markets are perfect. The case for free markets is that government control of markets, especially asset markets, has always been much worse." This argument takes us away from the main point: the government has always, and will always, set the rules of the game in markets. And right now, we need some better rules.

The financial crisis happened because everyone got it wrong. Bankers, regulators, mortgage brokers, home buyers, economists -- everyone. In response, everyone needs to look at what they did wrong and how they can do better, not start flame wars in the New York Times magazine pointing fingers. Economists can help make better rules and more effective government spending by focusing on the microeconomics of the institutional, collective action, and behavioral fields. At this point, economics is such a young and naive science that "general equilibrium" -- the attempt to model everything -- is a purely academic exercise with less practical relevancy than attempts to model the movements of ants in anthills. Let's take our best shot at figuring out what's wrong the with regulations we have, and see if we can't do a little better. Of course technocrats aren't any smarter than bankers and the new regulations might make things even worse; that's why we should test our theories using experiments. If things get screwed up anyway, we can always challenge the new rules under the "just and reasonable" standard of common law.

Maybe one day I'll believe in macro, but right now I say focus on the nerdy specifics of microeconomics and leave the macroeconomy to its "animal spirits."

Monday, September 14, 2009

I Hate Paper, Part 2

An update on the paper survey situation: We had to print a few thousand more pages over the weekend for another survey. We arranged with a new Print Company #4 in advance, and negotiated a great rate -- but when we set out to deliver the file and start printing, they informed us that we had been bumped and they wouldn't get to us until maybe Tuesday of next week. I reluctantly called up Print Company #2, who assured us that they now have paper, toner and a printer that doesn't jam and would be willing to work all night if necessary to get everything ready for Monday morning. Great! Paper, toner, a printer, and staff -- what else could I need?

Power. When we got to the office, the lights were out and the machines were off. D'oh.

Eventually power came back and they worked all day Sunday to make up for lost time. Great! There isn't anything else that could possibly go wrong, right? Right?

Wrong. When they showed up today with 9 boxes of surveys, three of the boxes had the page 6 from the survey I printed last week...

Apparently, when the power went off one time, they mixed up the papers they were photocopying, so we have 8 pages on high school enrollment questions and one page of tailor business expenses. Oops!

Power. When we got to the office, the lights were out and the machines were off. D'oh.

Eventually power came back and they worked all day Sunday to make up for lost time. Great! There isn't anything else that could possibly go wrong, right? Right?

Wrong. When they showed up today with 9 boxes of surveys, three of the boxes had the page 6 from the survey I printed last week...

Apparently, when the power went off one time, they mixed up the papers they were photocopying, so we have 8 pages on high school enrollment questions and one page of tailor business expenses. Oops!

Wednesday, September 9, 2009

What I do

I've often wondered why Michael Kremer doesn't give a TED Talk. Mankew blogged a link to a talk he gave at this summer's NBER conference that answered my question.

Kremer is one of the PIs on my education project, and in the talk he explains a little bit about why we do what we do, and how we do it. It's directed at economists, so beware the jargon and assumed knowledge.

Kremer is one of the PIs on my education project, and in the talk he explains a little bit about why we do what we do, and how we do it. It's directed at economists, so beware the jargon and assumed knowledge.

Tuesday, September 8, 2009

When Will Paper Surveys Die?

At IPA-Ghana, we almost exclusively use paper to keep track of everything, despite that fact that just about everyone who works with us carries around enough processing power in their pocket to administer a reasonably complex survey using just their cell phone. The main argument against digital data collection is usually just that the researchers are uncomfortable with the idea of not having a piece of paper to look back to, just in case it's ever necessary. In the words of a coworker, "I feel like I'm at that firm in the 80s scared of the word processor!" It does feel rather similar to the, "If I'm not using a typewriter, how will I have a carbon copy?" argument.

The mobile computing technology is absolutely there. You can administer a survey on a cell-phone like PDA (or PDA-like cell phone), send the data back to the researcher's computer, and have the researcher send back a randomized treatment (eg, gets a loan/doesn't get a loan) instantly. Or you can use a $300 netbook, plug a little 3G modem into, and do the same. Sure, dealing with all this technology would be frustrating, but it would be an exciting type of frustrating, as opposed to the hassle of paper surveys, which just make you pull your hair out -- this I know from experience, having lost a lot of hair today...

I was supposed to have all of our paper questionnaires ready to go by 9 am this morning on a new survey for the consulting project. I went to one printing company, but gave up because his machine was too slow. Back at the office, I realized that his virus-ridden computer corrupted my file and everything I printed had errors and was completely worthless. So I spent the next hour re-doing everything I had done between 12 am and 1 am this morning. After sorting this out, I set up to print with the office printer, which just returned after three months of being MIA at a repairs shop. Well, it only lasted about 20 pages before breaking again. I set off for a second printing company thinking, "Wow, I'm really having bad printer juju today" -- I didn't know the half of it. The second print company is fast, but his machine kept jamming... and jamming... and jamming... until the moment I stood up to leave and find a third printer, when it miraculously starting working again... until he ran out of paper! That's right, the professional printing company ran out of paper. They started cutting A3 paper in half to make A4 paper, but of course that made the printer start jamming... and jamming... and jamming... until I stood up to go again, when it again miraculously began printing... until... they ran out of ink! The printing company. Ran out of paper. Then ink.

I found another printing company, and finally got the questionnaires to the surveyors by 2:30 pm.

When will paper surveys die? Not soon enough...

The mobile computing technology is absolutely there. You can administer a survey on a cell-phone like PDA (or PDA-like cell phone), send the data back to the researcher's computer, and have the researcher send back a randomized treatment (eg, gets a loan/doesn't get a loan) instantly. Or you can use a $300 netbook, plug a little 3G modem into, and do the same. Sure, dealing with all this technology would be frustrating, but it would be an exciting type of frustrating, as opposed to the hassle of paper surveys, which just make you pull your hair out -- this I know from experience, having lost a lot of hair today...

I was supposed to have all of our paper questionnaires ready to go by 9 am this morning on a new survey for the consulting project. I went to one printing company, but gave up because his machine was too slow. Back at the office, I realized that his virus-ridden computer corrupted my file and everything I printed had errors and was completely worthless. So I spent the next hour re-doing everything I had done between 12 am and 1 am this morning. After sorting this out, I set up to print with the office printer, which just returned after three months of being MIA at a repairs shop. Well, it only lasted about 20 pages before breaking again. I set off for a second printing company thinking, "Wow, I'm really having bad printer juju today" -- I didn't know the half of it. The second print company is fast, but his machine kept jamming... and jamming... and jamming... until the moment I stood up to leave and find a third printer, when it miraculously starting working again... until he ran out of paper! That's right, the professional printing company ran out of paper. They started cutting A3 paper in half to make A4 paper, but of course that made the printer start jamming... and jamming... and jamming... until I stood up to go again, when it again miraculously began printing... until... they ran out of ink! The printing company. Ran out of paper. Then ink.

I found another printing company, and finally got the questionnaires to the surveyors by 2:30 pm.

When will paper surveys die? Not soon enough...

Sunday, September 6, 2009

View from the Office

I've been getting some requests for pictures (from loyal readers: Mom and Dad..), but I have to admit that I haven't been very good at taking them so far. I'm about 9 months behind in sorting out the pictures I have taken, so snapping new ones just sounds like more work...

Nonetheless, here is the view from my office in Accra, one of the few pictures I have taken. There's a nice little sliver of ocean in there somewhere.

Nonetheless, here is the view from my office in Accra, one of the few pictures I have taken. There's a nice little sliver of ocean in there somewhere.

Saturday, September 5, 2009

Linkspam

It's been very busy around the office lately (and will continue to be for some time). Today, I'm just forwarding all the links our Ghana office spammed each other with over the last few days.

*Why I don't believe in macroeconomics

*Good summary of the recent research on microfinance that captures why I have zero (0) interest in the field. It's a business, not a development program.(HT: Rob)

*Technology is way, way overblown in education. (HT Rob)

*All of the Ghana RAs are currently in Accra, and we've been enjoying late-night Stata sessions -- there is value to the comradeship. (HT Alex)

*Usually, we are more alone together (HT: Alex)

*Why I don't believe in macroeconomics

*Good summary of the recent research on microfinance that captures why I have zero (0) interest in the field. It's a business, not a development program.(HT: Rob)

*Technology is way, way overblown in education. (HT Rob)

*All of the Ghana RAs are currently in Accra, and we've been enjoying late-night Stata sessions -- there is value to the comradeship. (HT Alex)

*Usually, we are more alone together (HT: Alex)

Tuesday, September 1, 2009

Economics Blog Nerdery

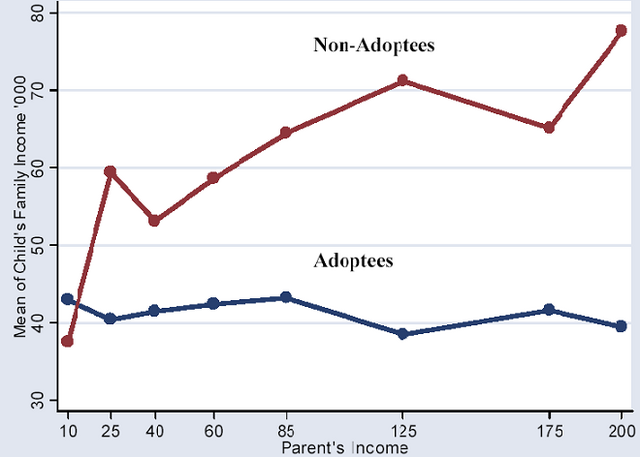

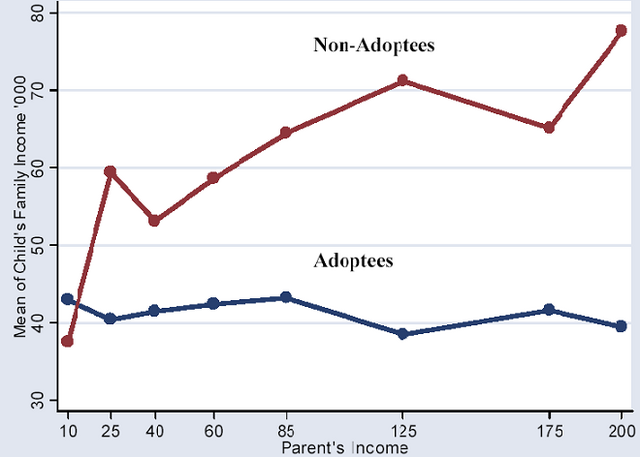

The economics blogosphere (yes, there is such a thing) has been alive recently about a post by Greg Manikew (yes, I am such a nerd that I read his blog) about a graph posted on the Economix blog (hold on, this post is about to get even nerdier). Marginal Revolution weighed in with its own graph, which blew me away. I’m all about graphs, developed a recent interest in adoption, and am listening to Gillian Welch’s ‘Orphan Girl’ right now, so I can’t help but take up the topic.

The Economix graph shows SAT scores versus parent’s income. Manikew goes off about omitted variable bias and claims the relationship is because smart people make more money and pass on their smart, money-making genes.

Marginal Revolution presents evidence from a grand experiment that seems to back this up. Turns out, Holt International randomly assigned children up for adoption to parents in the 70s and 80s. This means that we wouldn’t expect any difference between the innate intelligence of children assigned to rich folks versus poor folks so any difference in outcomes between children adopted by rich families versus poor families is due purely to nurture.

Wow! This graph seems to show a huge, huge role for nature and a very limited role for nurture. This rocked my world a little bit. I’m a firm believer in the power of early childhood education, etc, but this graph seems to show that even if you do the most extreme intervention imaginable – literally scoop up infants from poor families and drop them in rich families – they wouldn’t have the genes to keep up with the rich families’ biological children.

Sounds too crazy to be true, doesn’t it? Well, don’t worry, it probably isn’t true – the graph doesn’t control for age, sex or education. The adopted children are 30% male and have a mean age of 27.8, compared to the biological children who are 61% male and have a mean age of 34. There’s that pesky omitted variable bias again. Without controlling for these things, the average difference in biological versus adopted children’s income is $19,000, but this shrinks to just $1,600 when the controls are added.

The paper the graph is lifted from is interesting raises a more interesting question: why are biological children are getting more education? (Which they do appear to be) Hard to say – nature is certainly part of the answer, as is mother’s nutrition. Family size is also much more important in predicting adopted children’s education than biological children’s, suggesting that, as much as we’d like to think otherwise, there may be some preference for biological children in adoptive families.

The Economix graph shows SAT scores versus parent’s income. Manikew goes off about omitted variable bias and claims the relationship is because smart people make more money and pass on their smart, money-making genes.

Marginal Revolution presents evidence from a grand experiment that seems to back this up. Turns out, Holt International randomly assigned children up for adoption to parents in the 70s and 80s. This means that we wouldn’t expect any difference between the innate intelligence of children assigned to rich folks versus poor folks so any difference in outcomes between children adopted by rich families versus poor families is due purely to nurture.

Wow! This graph seems to show a huge, huge role for nature and a very limited role for nurture. This rocked my world a little bit. I’m a firm believer in the power of early childhood education, etc, but this graph seems to show that even if you do the most extreme intervention imaginable – literally scoop up infants from poor families and drop them in rich families – they wouldn’t have the genes to keep up with the rich families’ biological children.

Sounds too crazy to be true, doesn’t it? Well, don’t worry, it probably isn’t true – the graph doesn’t control for age, sex or education. The adopted children are 30% male and have a mean age of 27.8, compared to the biological children who are 61% male and have a mean age of 34. There’s that pesky omitted variable bias again. Without controlling for these things, the average difference in biological versus adopted children’s income is $19,000, but this shrinks to just $1,600 when the controls are added.

The paper the graph is lifted from is interesting raises a more interesting question: why are biological children are getting more education? (Which they do appear to be) Hard to say – nature is certainly part of the answer, as is mother’s nutrition. Family size is also much more important in predicting adopted children’s education than biological children’s, suggesting that, as much as we’d like to think otherwise, there may be some preference for biological children in adoptive families.

Subscribe to:

Posts (Atom)